All Categories

Featured

Table of Contents

Nelson Nash. This publication lays out the Infinite Financial Principle (Life insurance loans). To be honest, I would certainly have instead gotten on the coastline than sat in the condo paying attention to Daddy read a financial book to us, but at the very same time, I was excited because I saw that Papa was thrilled. My Papa is a Chiropractor.

He remained in method long before I was born. It was on that holiday, and particularly the message in that book, Becoming Your Own Lender, that transformed the program of our family members's life for life. Below's an intro to the Infinite Financial Idea and just how McFie Insurance policy (previously Life Benefits) started.

Nelson Nash, served in the USA Air Pressure, worked as a forestry specialist and later on became a life insurance policy agent and an investor. To obtain cash for his actual estate investments prior to the 1980s, Mr. Nash was accustomed to paying 9.5% on the cash he borrowed.

Nash explained in his book. Soon, Dad got on the phone telling friends and family concerning the Infinite Financial Principle. During the week, in his center, he would likewise tell his individuals concerning guide and share the principle with them also. A few months later, he made a decision to obtain his life insurance policy producer's certificate, so he could create, market, and solution Whole Life insurance policy policies.

Can anyone benefit from Infinite Banking Benefits?

The forward to Prescription for Wealth was written by Mr.

Is Infinite Wealth Strategy a good strategy for generational wealth?

As the Infinite Banking Concept financial onCaptured more and even more people began to want dividend-paying Whole Life insurance policiesInsurance coverage Life insurance policy representatives around the nation began to take note. Some agents loved the concept, some agents loved the idea of making use of the idea as a sales system to offer more life insurance.

To design a good plan that functions well for the Infinite Banking Principle, you need to minimize the base insurance coverage in the plan and boost the paid-up insurance cyclist. It's not difficult to do, yet compensations are paid directly in relation to just how much base insurance remains in the plan.

Policy Loans

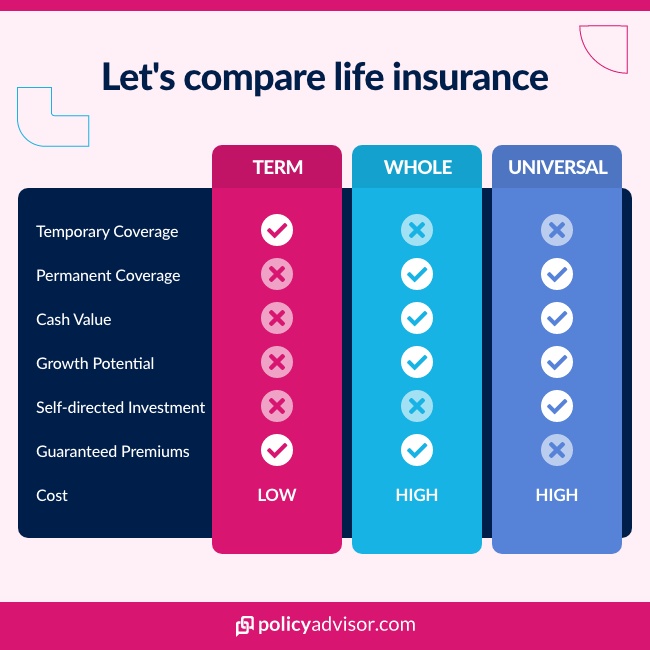

Some representatives want to reduce their payment to make a great policy for the client, but lots of agents are not. However, several life insurance policy agents informed their customers that they were creating an "Infinite Financial Plan" yet finished up composing them a bad Whole Life insurance policy plan, or also worse, some kind of Universal Life insurance coverage policy, whether it was a Variable Universal Life insurance plan or an Indexed Universal Life insurance coverage policy.

An additional danger to the principle came due to the fact that some life insurance coverage representatives began calling life insurance policy plans "financial institutions". This language captured the focus of some state regulatory authorities and constraints followed. Points have actually changed over the last numerous years. The IBC is still around, and it still functions. Mr. Nash's son-in-law, David Stearns, still runs the company Infinite Financial Concepts, which to name a few things, sells guide Becoming Your Own Banker.

IBC is usually referred to as "infinite" due to its adaptable and multifaceted method to personal money administration, especially with the use of entire life insurance plans (Bank on yourself). This idea leverages the cash worth element of whole life insurance policy policies as a personal banking system.

How does Bank On Yourself compare to traditional investment strategies?

This access to funds, for any type of reason, without having to get approved for a lending in the standard feeling, is what makes the concept appear "infinite" in its utility.: Utilizing plan lendings to fund company obligations, insurance, fringe benefit, and even to inject funding into partnerships, joint ventures, or as an employer, showcases the convenience and infinite possibility of the IBC.

As constantly, use discernment and hearken this guidance from Abraham Lincoln. If you want unlimited financial life insurance policy and remain in the market to obtain an excellent plan, I'm prejudiced, yet I recommend our household's company, McFie Insurance. Not just have we concentrated on establishing up good plans for use with the Infinite Financial Principle for over 16 years, however we also possess and use the very same sort of plans personally.

Either method getting a 2nd opinion can be indispensable. Whole Life insurance policy is still the premier monetary possession.

What are the benefits of using Infinite Banking Vs Traditional Banking for personal financing?

I do not see that transforming anytime soon. Whether you're interested in finding out more regarding unlimited banking life insurance policy or seeking to begin using the concept with your very own policy, call us to arrange a free method session. There's a lot of complication around financing; there's so much to understand and it's irritating when you don't know enough to make the very best economic choices.

What is Infinite Financial and how does it function? That is Infinite Banking for? If you're trying to understand if Infinite Banking is appropriate for you, this is what you require to understand.

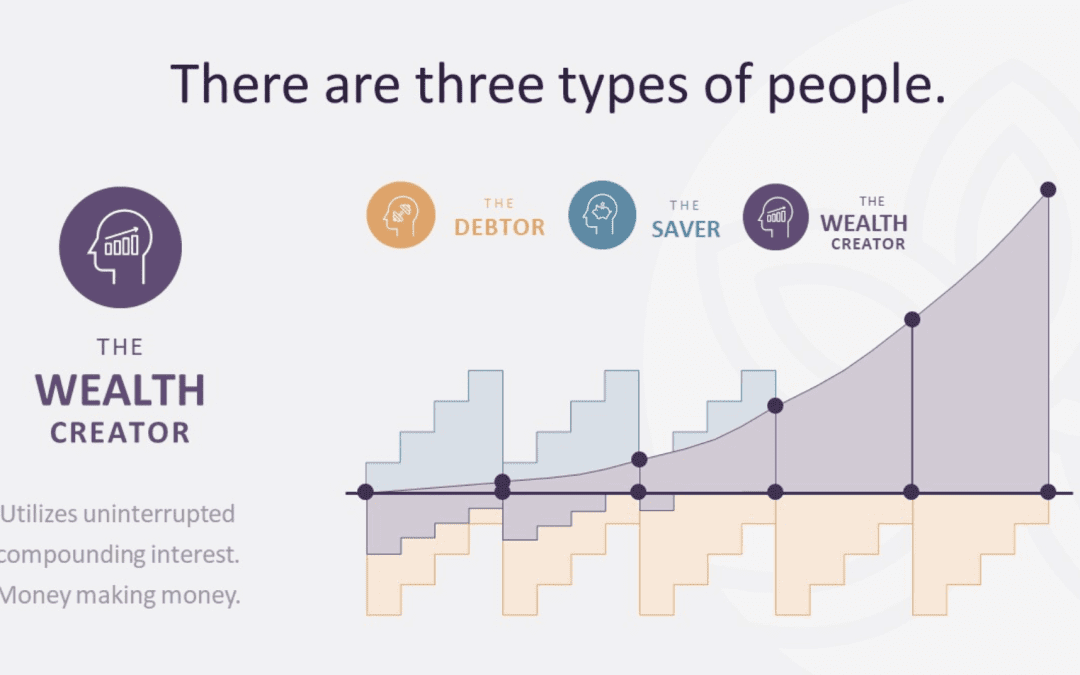

Too many individuals, himself consisted of, got right into economic difficulty due to dependence on banking organizations. In order for Infinite Banking to work, you need your very own financial institution.

Policy Loan Strategy

The major distinction in between the 2 is that getting involved entire life insurance coverage policies enable you to get involved or get dividends based on earnings of the insurance coverage business. With non-participating policies you do not take part or receive dividends from the insurance policy firm.

Furthermore, plan financings are tax-free. You can use the passion and returns you've gained without paying tax obligations on that money. Relatively, if you withdraw your cash money worth, any quantity over your basisthe amount you have actually contributed in insurance premiumswill be tired. In terms of repaying your policy finances, you operate as your own lender and obtain to determine the repayment timetable.

Dividend-paying entire life insurance policy is extremely low danger and offers you, the insurance policy holder, a lot of control. The control that Infinite Financial offers can best be organized right into two classifications: tax benefits and property protections. One of the reasons whole life insurance policy is perfect for Infinite Financial is just how it's strained.

Latest Posts

Bank On Yourself: Safe Money & Retirement Savings Strategies

Infinite Bank

Infinite Banking Concept Life Insurance